The healthcare law (Affordable Care Act) expands health insurance coverage to millions of Americans, starting January 1, 2014. The law creates the Health Insurance Marketplace – a new way for individuals, families, and small businesses to get affordable health insurance.

The healthcare law (Affordable Care Act) expands health insurance coverage to millions of Americans, starting January 1, 2014. The law creates the Health Insurance Marketplace – a new way for individuals, families, and small businesses to get affordable health insurance.

Health Insurance Marketplace Facts:

- On October 1, 2013, Health Insurance Marketplaces will open for business, and millions of Americans can begin enrolling in new private or public health insurance coverage under the Affordable Care Act. This new insurance coverage begins January 1, 2014.

- Through the Illinois Health Insurance Marketplace, consumers will be able to see if they are eligible for newly expanded Medicaid coverage, or for financial help in the form of premium subsidies, called “Advanced Premium Tax Credits,” that will lower their monthly health insurance premiums. Financial assistance will be available to individuals and families who earn up to 400% of the Federal Poverty Level (about $44,680 for an individual and $92,200 for a family of four).

- Most people who will be able to enroll in affordable coverage through the Marketplace do not know about the new benefits or how to enroll, or that they can enroll starting THIS October.

- Marketplaces will help consumers enroll through consumer-friendly websites, toll-free hotlines, and “Navigator”programs.

Marketplaces will make applying for health coverage and financial assistance easier. Marketplaces will use a single streamlined application for both private health insurance and Medicaid (medical card) coverage, and will provide help with enrollment through consumer-friendly websites, call centers, and in-person assistance, including new “navigator” programs. Navigators will conduct targeted outreach and will provide one-on-one assistance to help consumers learn about and enroll in new coverage options and gain financial assistance.

Will You Benefit from the Health Insurance Marketplace?

Many of us will benefit from the Marketplace, or know someone who will. If you are under the age of 65 and are uninsured, under insured, can”t get insurance due to pre-existing health conditions, can’t afford insurance, currently purchase your own plan, or get insurance coverage through a small employer, the Marketplace can help!

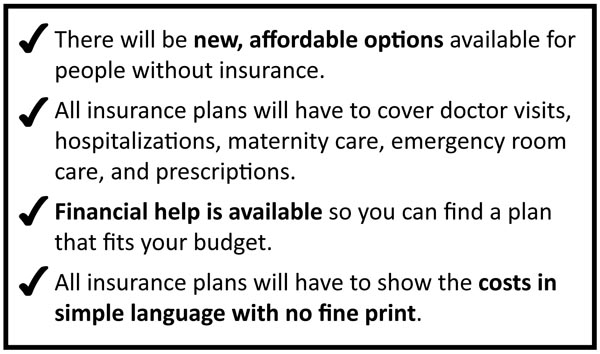

In the Marketplace…

- There will be health insurance plans that allow you to keep your doctors.

- Quality and affordable plans cannot deny coverage due to pre-existing or chronic conditions.

- Plans must include certain set basic benefits.

- Participation is voluntary. If you like the insurance you have, you can keep it.

- Plans cannot charge women higher rates than men.

- Strong oversight will protect you from misleading information and hidden costs.

- Members of Congress will be purchasing their health insurance here, just like the rest of us.

About the Individual Mandate and the Tax Penalty

Beginning in 2014, most people will be expected to have health insurance coverage or pay a tax penalty. You will not have to pay the tax penalty for not having health insurance coverage if:

- You have a religious objection;

- You are in jail;

- You are an undocumented immigrant;

- You are in between jobs and without insurance for three months;

- Your family”s income is too low to be required by the IRS to file a tax return.

The tax penalty in 2014 will only be $95 per adult and $47.50 per child, up to a family maximum of either $285 or 1% of your family income, whichever is greater. However, the tax penalty will increase each year.

The Cost of the Tax Penalty vs. the Value of Health Insurance

Many lower-income people will be choosing between paying the tax penalty for not having insurance, versus getting health insurance through the Marketplace. Insurance protects you from high costs when something bad happens. No one plans to get sick or hurt, but most people need to get treated for an illness or injury at some point, and health insurance helps pay these costs. Before deciding to go uninsured and take the tax penalty, consumers should find out about the financial help that will be available through the Marketplace to make your insurance coverage affordable. See the next section for more information on how the Marketplace will make health insurance affordable!

Making Health Insurance Affordable!

In the Marketplace there will be new, expanded programs available, and more people than ever before will qualify for free or low-cost health insurance programs.

Advance Premium Tax Credits

Starting in 2014, the Marketplace will provide financial help in the form of premium subsidies, called “Advanced Premium Tax Credits,” that will lower monthly health insurance premiums for people under the age of 65 who purchase health insurance coverage through the Marketplace. The subsidies will be available to individuals and families who have incomes between 139 – 400% of the Federal Poverty Level (between about $15,500 – $44,680 for an individual and $32,000 – $92,200 for a family of four). To see if you would qualify for an Advance Premium Tax Credit, use this premium calculator: http://healthreform.kff.org/SubsidyCalculator.aspx

[1]

Medicaid Expansion

Millions of currently uninsured low-income individuals will qualify for Medicaid in 2014 as a result of health reform. Currently, being low-income is not enough to qualify for Medicaid in Illinois; you must also be either a child under age 19, a pregnant woman, parent of minor children or have a disability. But starting in 2014, under the health reform law, Illinois is expanding the Medicaid program so that anyone who earns less than 139% of the Federal Poverty Level will be eligible (about $15,000 for an individual) through the Marketplace.

In Illinois, there are 1.7 million currently uninsured individuals. Roughly half will be eligible for Advance Premium Tax Credits and about 342,000 will qualify for expanded Medicaid, allowing for many Illinoisans to finally get quality and affordable health care.

Back to The Health Care Law And You [3].