August 28, 2013

Dear Friends,

In just over a month, the Illinois Health Insurance Marketplace will open, giving us unprecedented access to affordable health insurance coverage. In Champaign County alone, we are expecting that at least 15,000 residents will be eligible for Medicaid. Thousands of others will be eligible for financial assistance to help pay for private health insurance plans. With so many of our family,friends, neighbors, and co-workers being affected by these changes, Champaign County Health Care Consumers (CCHCC) needs your help NOW more than ever!

For years, CCHCC and health care advocates like you have been fighting for new and improved ways for everyone to access affordable health care and health insurance. Finally, weare only a month away from the Health Insurance Marketplace! You can help by getting you and your family ready, sharing this information with others, and helping support our work. In this letter,we will go over the nuts and bolts of the Health Insurance Marketplace so that you will be ready to enroll!

Why Should I Use the Health Insurance Marketplace?

Because of the health care law, the Health Insurance Marketplace (sometimes called the Exchange) is the place you can go to get health insurance coverage using a single, streamlined application. Through the Marketplace, you will be able to see if you and your family qualify for Medicaid or for financial assistance to help make insurance affordable for you.

If you are between the ages of 19 and 64 and are currently uninsured, use an individual plan, area dependent on someone else’s insurance plan, or want to see what other options you have, you should shop for insurance coverage through the Marketplace.

All plans offered in the Marketplace must cover the same set of Essential Health Benefits – like doctor visits, hospitalizations, maternity care, emergency room care,prescriptions, and much more. It will also be easy to shop for and compare insurance plans in simple, consistent language with no fine print.

These insurance plans will meet your requirement to have minimum essential coverage so you do not have to pay a penalty. If you already have coverage through an employer plan, Medicare, Medicaid, or veterans health care programs, you do not have togo through the Marketplace to get insurance and you have the minimum essential coverage so you do not have to pay a penalty! There are also other exemptions from the penalty – please contact CCHCC if you have questions about your specific situation.

If you are 65 years of age and older, on Medicare, looking for a Medicare Advantage plan, or eligible for Medicare and want to apply,you should contact a Senior Health Insurance Program (SHIP) office for assistance instead of going through the Marketplace. Please contact CCHCC at (217) 352-6533 if you need help finding a SHIP office.

Types of Insurance Offered Through the Marketplace

When you go to The Marketplace – whether through the website, using a paper application, over the phone, or in person – you will first be asked to provide some basic information about yourself (and members of your family living with you). Next, you will be asked if you are employed and about other sources of income you and your family may have. These two steps will help determine your family size and income level to find health insurance options for you and your family through The Marketplace.

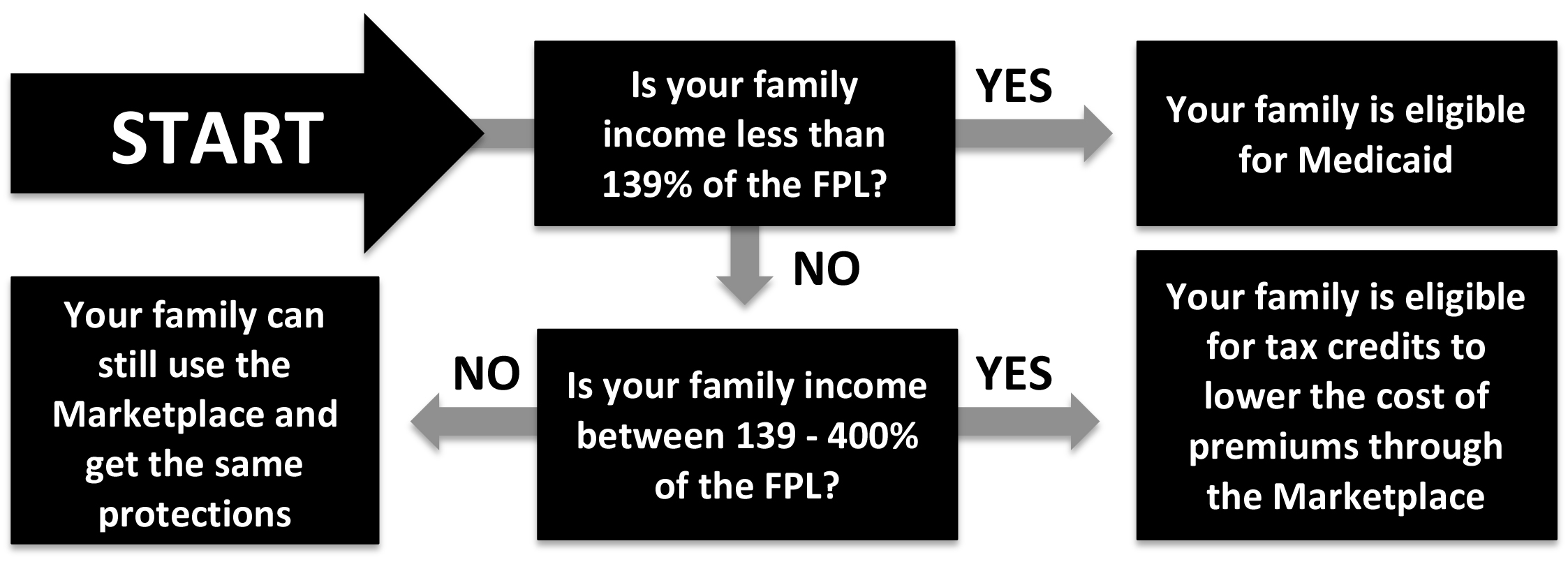

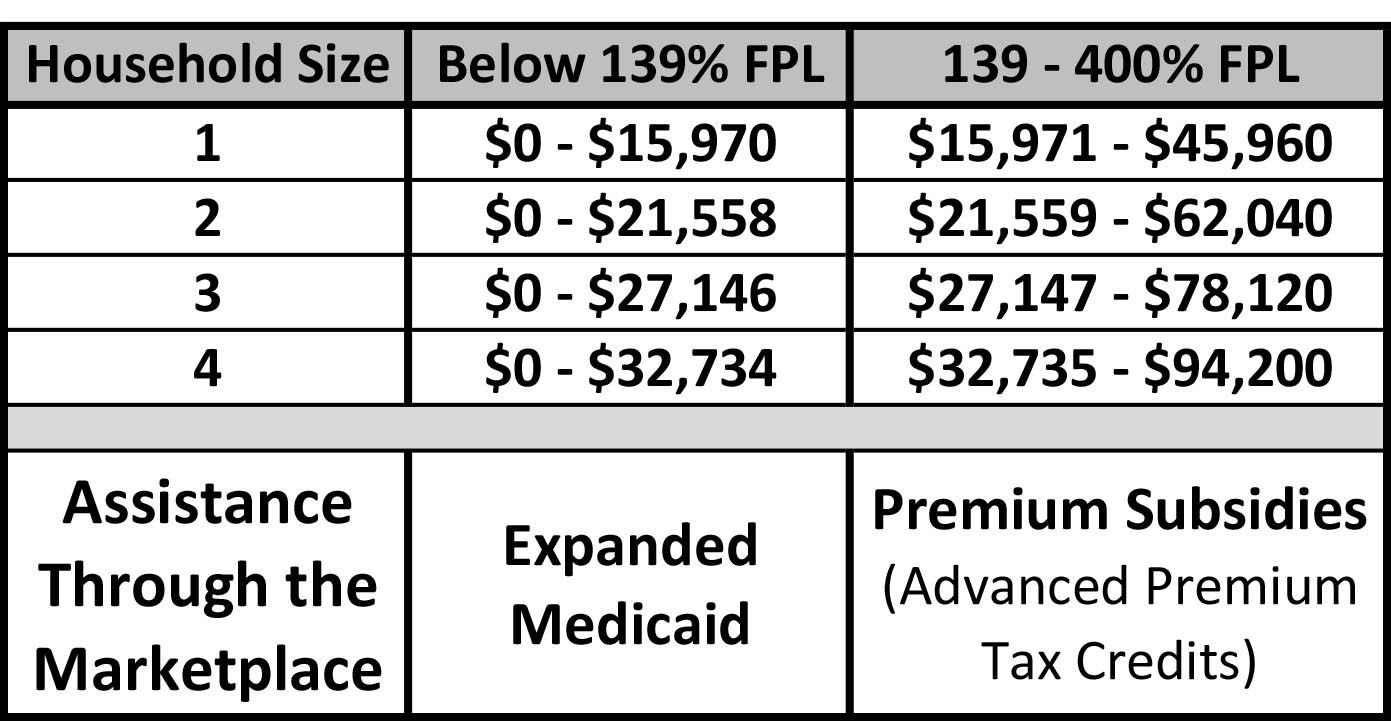

If you earn less than 139% of the Federal Poverty Level (FPL) ($15,971 for an individual and $32,735 for a family of four) you should qualify for public insurance coverage through the expanded Medicaid program. If this is the case,you will be directed to the next steps to enroll in Medicaid.

In Illinois,Medicaid is being expanded so that it will cover everyone who is low-income.Currently, you have to be low-income and meet certain categorical requirements. In January, Medicaid will expand to provide health care coverage to everyone who needs it most, based solely on income.

If you earn between 139% and 400% of the FPL (between $15,971to $45,960 for an individual and between $32,735 and $94,200 for a family off our), you will be able to purchase private health insurance coverage Through the Marketplace and receive financial assistance to help lower your monthly insurance costs (premiums). If this is the case, you will next look at the financial assistance options and plans available.

If you earn more than 400% of the FPL, you can still purchase private health insurance coverage through the Marketplace; you will receive the same benefits and protections of the Marketplace, but you will not qualify for financial assistance. If this is the case, you will next be able to compare plans and purchase your health insurance.

Making Health Insurance Affordable: Financial Assistance

The health reform law is making health insurance more affordable in many ways, both inside and outside of the Marketplace. Did you know that in 2014 insurance companies can no longer charge a woman more for her insurance coverage compared to a man of the same age? Insurance companies will also no longer be able to charge more,or even deny coverage, for someone with pre-existing or chronic conditions!

In addition to these changes to help curb the cost of health insurance, there will be financial assistance available to most individuals and families who will go through the Marketplace to purchase insurance.

As mentioned earlier, if you earn less than 139% of the FPL, you will qualify for Medicaid. This means you will not have any monthly premiums for your insurance coverage, and you will only need to pay small out-of-pocket costs when you actually use your insurance.

If you earn between 139% and 400% of the FPL, you will be able to choose a private health insurance plan and receive financial assistance through Advanced Premium Tax Credits to reduce how much you pay each month for the insurance premium. You will have options of how to use the Tax Credits. You can either apply it directly to your premium each month or claim it at the end of the year on your tax return.

For example, let’s say the Marketplace determines that your Advanced Premium Tax Credit for 2014is $2,400 (which is $200 each month). If the health insurance plan you want to purchase is $300 each month, you can choose to use the $200 tax credit each month to reduce your cost and only pay $100 to the insurance company for your premium. Or you can pay the full $300 each month and then claim your tax credit on your 2014 tax return (filed in 2015). You even have the option to use a smaller amount each month, so let’s say only $100 of the $200 you qualify for,and then you can claim what you do not use during the year on your tax return.

The Advanced Premium Tax Credits are there to help you and your family find a health insurance plan that you like and make it more affordable to you. Because it is based on your income and family size, it is important to contact The Marketplace (or the person who helps you apply through the Marketplace) if there are changes to your income or family size during the year, since this may change the size of the Tax Credit you qualify for.

If you have insurance coverage through your employer or qualify for Medicaid and instead choose to purchase an individual plan through the Marketplace, most likely you will not be eligible for these assistance options. You also do not qualify for this financial assistance if you purchase health insurance outside of the Marketplace.

Private Insurance Plans Levels: Bronze, Silver, Gold and Platinum

If you are purchasing private insurance through the Marketplace (earn at least 139% of the FPL), you will be able to compare apples to apples. All plans will offer the same set of Essential Health Benefits. But they will be grouped into four categories (or levels) – Bronze, Silver, Gold and Platinum – based on how much benefit/coverage you will get from your insurance.

It is important to understand that these plans will offer the same quality and amount of care. The difference between the levels is how much you pay for premiums each month and how much your out-of-pocket expenses are (like co-payments,deductibles, and prescriptions). A Bronze plan will have the cheapest premium seach month while the Gold and Platinum plans will cost the most per month.However, when you use your insurance, you will pay more out-of-pocket with a Bronze plan and you will pay the least out-of-pocket using the Platinum plan.For example, if you have an accident and break your arm, you will pay more of your bills for the emergency room visit, x-rays and cast, physical therapy, and whatever else you might need if you have a Bronze plan than if you have a Platinum plan.

Why pay more for your premium each month? When deciding what plan to purchase, keep in mind what your health care needs are. If you have chronic conditions, go to the doctor often, have a lot of prescriptions, or expect you may need to use your health insurance frequently, it may be in your best interest to get a Gold or Platinum plan. You will pay more each month for your premium, but due to lower out-of-pocket costs, it can save you money in the long run. Keep this in mind when you look at your budget and what you can afford to spend on health care.

Now, It’s Time to Get Health Insurance!

Starting October 1, 2013, you will be able to access The Marketplace through a consumer-friendly website (Health Care.gov), a call center(1-800-318-2596), and most importantly, at locations that provide in-person assistance (like CCHCC). You can only enroll in a plan from October 1, 2013through March 31, 2014 during a time called Open Enrollment. This health insurance coverage will start as early as January 1, 2014.

While there is a six-month period when you can apply through the Marketplace, we encourage youto apply early! If you want your insurance coverage to start January 1, 2014,you must apply for it before December 15 of this year.

What happens if something changes? After March 31, 2014, you can apply for coverage, or change your coverage, through the Marketplace if certain life events occur like: you move a large distance or to a different state, you lose insurance coverage through your job, or your family size changes (you have a child, you get married, etc.).

You can start to prepare for the Marketplace by gathering financial documents (like your tax return and pay stubs), thinking about what your health care needs are, looking at your budget to see how much you can afford to spend, and making a list of questions you might have. You can also check out the re-launched Health Care.gov website – this is the Marketplace website for Illinois.Currently, it has great information and resources to help you get ready for The Marketplace.

Count on CCHCC – We are here to help!

Champaign County Health Care Consumers is here to help you get ready for the Marketplace. On September 12, 2013 at 7 p.m., CCHCC will host a Community Meeting on The Marketplace and Open Enrollment at the Champaign Public Library. Please see the enclosed green card for more information about this event and for more Marketplace resources!

For years, CCHCC and health care advocates like you have been fighting for new and improved ways for everyone to get health insurance. Finally, we are only a month away from the Health Insurance Marketplace and we need your help. Please help spread the word by sharing these materials with your family, friends, co-workers,neighbors, and anyone else who you think will benefit from the Marketplace!

1. I want to help spread the word about the Health Insurance Marketplace!

- I will share these materials and resources with my friends, family, and co-workers!

- Add me to CCHCC’s email list so I can stay up-to-date on the Marketplace

- I will like CCHCC on Facebook so I can stay up-to-date on the Marketplace

2. I need help or want more information through the CCHCC Hotline.

3. I would like to make a contribution to support CCHCC!

Thank you for your support!

Download the pdf of this letter