October 29, 2020

Dear friends,

Did you know that working people in Illinois pay more of their income in taxes than wealthy Illinoisans?

Currently, all Illinoisans pay a flat tax of 4.95% across the board. This means that all incomes are taxed equally. The federal government, and most states in our nation, levy income taxes via a system of tax brackets — the more you earn, the higher your tax rate as a percentage of income. Illinois is one of a handful of states that do it differently, using a 4.95% flat tax rate that’s the same whether you’re a millionaire or an hourly worker earning minimum wage. The obvious problem with that is, while 4.95% means a lot more money from the millionaire than from the minimum wage worker, it’s a far more significant hit to the minimum wage worker, who is likely already living on the edge financially.

Illinois’ current tax system is unfair for middle and lower-income families – taxing everyone at the same rate, regardless of income.

The Champaign County Health Care Consumers (CCHCC) has endorsed the Illinois Fair Tax constitutional amendment, and we urge every IL voter to vote “YES” for the Fair Tax!

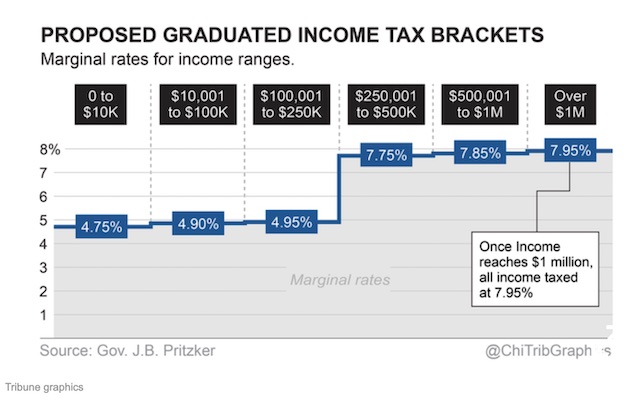

Please read below for more information about the Fair Tax constitutional amendment, and to learn more about why our state’s current income tax system is problematic, both for tax payers, and for our state’s economy. You can also see the tax brackets that would be created under the Fair Tax.

Only a few more days left to vote!

There are only 6 more days left to vote. Whether you early vote or go vote in person on Tuesday, November 3, we urge you to vote “YES” for the Fair Tax amendment.

IL’s taxing system

Illinois suffers from one of the most unfair taxing systems in the nation, as it fails to tax people relative to their income – contributing to a structural deficit, inadequate levels of core services to Illinois communities, and a bruised state economy. A Fair Tax would lower rates for the working and middle-class families in Illinois and increase rates for the people who can afford them – our state’s highest income earners. Fiscal policies should ensure that all communities can thrive.

Illinois’s current “flat tax” is written into our State’s Constitution, and that’s why, in order to change it, we need a Constitutional Amendment. Currently under the Illinois Constitution’s Article IX, Section 3, it states that tax on income shall be at a non-graduated rate, and only one such tax shall be imposed at one time on people and corporations. When we go to the polls this November we have the opportunity to vote on amending the Illinois Constitution by removing Section 3 to allow for a graduated income tax.

Why is a Fair Tax important to Illinois?

With a Fair Tax, the state’s general fund and the private sector economy will improve. Illinois has been suffering from a structural deficit driven by an insufficient revenue system that fails to keep up with the modern economy. A Fair Tax will shrink this deficit.

A Fair Tax would ensure that revenues for critical state investments grow along with the economy. Consumer spending would not be harmed by the Fair Tax increase because the increase will be affecting taxpayers with more substantial wealth. Revenue growth would be enhanced to the point where it could correspond to long-term economic growth, and the new revenue would fund public services such as education, healthcare, and social services. This would help empower working class Illinoisans, drive social mobility, and mitigate the negative impacts of increasing income inequality.

A Fair Tax would correct Illinois’s upside-down tax code.

Under the current system, the bottom 20 percent of Illinoisans pay nearly 2 times more the taxes as a share of their income, than wealthy Illinoisans.

Illinois ranks as the eighth-most-regressive taxing state in the nation, meaning it is among the worst offenders of state tax systems that make incomes more unequal after taxes than before.

Illinois is 1 of only 9 US states that still impose a flat rate on the income of all earners.

Why Illinois needs to change its tax system

Illinois’ chronic budget mess is driven mostly by its almost $140 billion in unfunded pension liability (the difference between what the state owes retired state workers and what’s available through its pension funds). The cost of that debt eats deeply into state income and services and has left Illinois with America’s lowest credit rating, at just above junk status. Republicans within and outside Illinois love to lay all this on the state’s current Democratic power structure, but in fact it’s an ongoing crisis that has been driven by decades of inadequate pension funding under both parties. As everywhere, the pandemic has only worsened the situation.

To learn more about Illinois’s credit rating problem, see this article

Tax brackets under the IL Fair Tax

The Fair Tax amendment would split that single 4.95% rate into six graduated rates, from 4.75% on the first $10,000 of income to 7.99% on income over $1 million. The corporate tax rate would also rise to 7.99%. Though it would boost state revenue by more than $3 billion annually, proponents say the effective tax bills of most Illinoisans will remain roughly the same or decrease modestly. It would be the rich and corporations fueling most of the new windfall. The amendment needs 60% approval to pass.

If you would like to see what your taxes would be like under the Fair Tax system, you can use this online Fair Tax Calculator

The Fair Tax can raise more than $3 billion in funds for schools and social services, and it can provide funds for vital services that assist people and families to help them out of poverty and it will correct the unfair tax burden that middle-class families.

Please join CCHCC in supporting the Fair Tax amendment! Vote YES for the Fair Tax!

Sincerely,

Champaign County Health Care Consumers