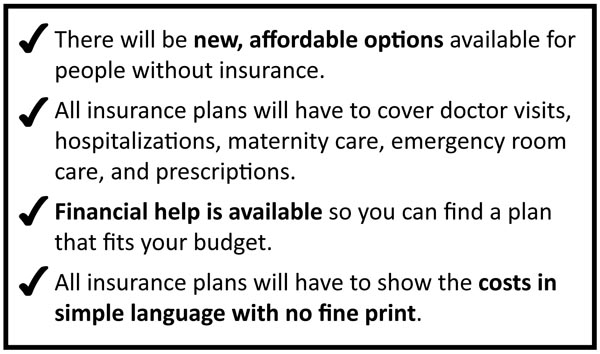

The Illinois Health Insurance Marketplace will open for business soon, and millions of Illinoisans can begin enrolling in new private or public health insurance coverage under the Affordable Care Act. This new insurance coverage begins January 1, 2014. You will be able to enroll in a plan through the Marketplace during Open Enrollment, which will go from October 1, 2013 through March 31, 2014.

Seven Things You Can Do to Get Ready Now

Learn about different types of health insurance. Through the Marketplace, you’ll be able to choose a health plan that gives you the right balance of costs and coverage.

Learn about different types of health insurance. Through the Marketplace, you’ll be able to choose a health plan that gives you the right balance of costs and coverage.

- Make sure you understand how insurance works, including deductibles, out-of-pocket maximums, co-payments, etc. (see our Glossary). You will want to consider these details while you are shopping around.

- Make a list of questions you have before it is time to choose your health plan. For example, “Can I stay with my current doctor?” “Will this plan cover my health care needs?” or “Will this plan cover my health costs when I’m traveling?”

- Start gathering basic information about your household income. Most people will qualify to get a break on costs, and you’ll need income information to find out how much you’re eligible for.

- Set your budget. There will be different types of health plans to meet a variety of needs and budgets, and breaking them down by cost can help narrow your choices.

- Find out from your employer whether they plan to offer health insurance, especially if you work for a small business.

- Explore local health care resources. Even though the Marketplace will be open soon, you may need help accessing health care before then. Contact CCHCC’s Consumer Health Hotline at (217) 352-6533 to get more information about existing programs that may help you get the health care you need.

Glossary of Health Insurance Terms

Co-insurance: Your share of the costs of a covered health care service, calculated as a percent (for example, 20%) of the allowed amount for the service. You pay co-insurance plus any deductibles you owe. For example, if the health insurance or plan’s allowed amount for an office visit is $100 and you’ve met your deductible, your co-insurance payment of 20% would be $20. The health insurance pays the rest of the allowed amount.

Co-payment: A fixed amount (for example, $15) you pay for a covered health care service, usually when you receive the service. The amount can vary by the type of covered health care service.

Deductible: The amount you owe for health care services your health insurance or plan covers before your health insurance or plan begins to pay. For example, if your deductible is $1,000, your plan will not pay anything until you’ve met your $1,000 deductible for covered health care services subject to the deductible.

Essential Health Benefits: The Affordable Care Act ensures health plans offered in the individual and small group markets offer a comprehensive package of items and services, known as essential health benefits. They include: ambulatory patient services; emergency services; hospitalization; maternity and newborn care; mental health and substance use disorder services; prescription drugs; rehabilitative and habilitative services and devices; laboratory services; preventive and wellness services and chronic disease management; and pediatric services, including oral and vision care. Insurance policies must cover these benefits in order to be certified and offered in Marketplaces, and all Medicaid state plans must cover these services by 2014.

Formulary: A list of prescription drugs (generic and brand-name) your insurance plan covers. A formulary may include how much you pay for each drug. If the plan uses “tiers,” the formulary may list which prescriptions fall into each price tier.

Health Insurance Marketplace: A new transparent and competitive insurance marketplace where individuals and small businesses can buy affordable and qualified health benefit plans or enroll in Medicaid. The Marketplace will offer you a choice of health plans that meet certain benefits and cost standards. Starting in 2014, even members of Congress will be getting their health care insurance through the Marketplace.

Out-of-Pocket Costs (Cost Sharing): Your expenses for medical care that are not reimbursed by insurance. This includes deductibles, co-insurance, and co-payments for covered services plus all costs for services that are not covered.

Out-of-Pocket Limit (OOP): The most you pay during a policy period (usually a year) before your health insurance or plan begins to pay 100% of the allowed amount. This limit never includes your premium or services your insurance plan does not cover. Some health insurance or plans do not count all of your co-payments, deductibles, co-insurance payments, out-of-network payments or other expenses toward this limit.

Premium: The amount that must be paid for your health insurance or plan. You and/or your employer usually pay it monthly, quarterly, or yearly.

Qualified Health Plan: Under the Affordable Care Act, starting in 2014, an insurance plan that is certified by a Marketplace, provides essential health benefits, follows established limits on cost-sharing (like deductibles, co-payments, and out-of-pocket maximum amounts), and meets other requirements. A qualified health plan will have a certification by each Marketplace in which it is sold.

Source: Taken, in part, from http://www.Health Care.gov

Updated 7/2/2013