October 29, 2020

Did you know that working people in Illinois pay more of their income in taxes than wealthy Illinoisans?

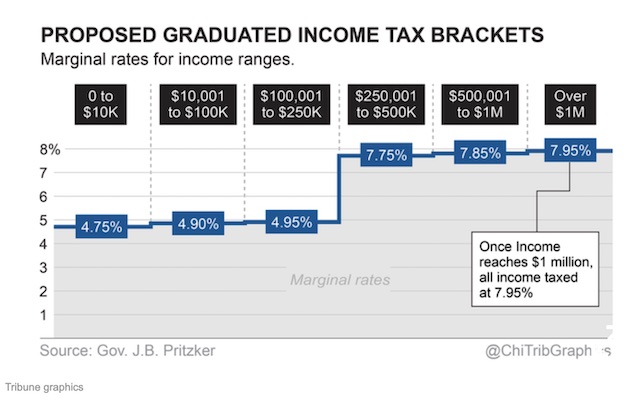

Currently, all Illinoisans pay a flat tax of 4.95% across the board. This means that all incomes are taxed equally. The federal government, and most states in our nation, levy income taxes via a system of tax brackets — the more you earn, the higher your tax rate as a percentage of income. Illinois is one of a handful of states that do it differently, using a 4.95% flat tax rate that’s the same whether you’re a millionaire or an hourly worker earning minimum wage. The obvious problem with that is, while 4.95% means a lot more money from the millionaire than from the minimum wage worker, it’s a far more significant hit to the minimum wage worker, who is likely already living on the edge financially.

Illinois’ current tax system is unfair for middle and lower-income families – taxing everyone at the same rate, regardless of income.

The Champaign County Health Care Consumers (CCHCC) has endorsed the Illinois Fair Tax constitutional amendment, and we urge every IL voter to vote “YES” for the Fair Tax!